Posts Tagged ‘current events’

Current Refinance Rates: Should You Make a Move?

As a mortgage loan officer with years of experience helping homeowners navigate the ups and downs of the housing market, I’ve seen firsthand how timely refinancing decisions can save families thousands of dollars. With interest rates fluctuating in response to economic shifts, December 2025 presents a pivotal moment for many homeowners. The big question on…

Read MorePortable Mortgages: What They Are and Why the Idea Is Gaining Attention in the U.S.

In a Real Estate & Mortgage Market where interest rates dipped super low during the pandemic, many homeowners are holding off on their next move more than ever, because they either bought a home during the pandemic-era interest rate market or they refinanced the mortgage they already had on their home into a very low…

Read MoreThe 50-Year Mortgage? Pros and Cons

In today’s wild housing market, where home prices have climbed higher while interest rates have not come down far enough, homebuyers are hunting for any edge to make ownership affordable. Enter the proposed 50-year mortgage – a loan term that stretches the traditional 30-year fixed-rate mortgage by two full decades. These half-century mortgages are not…

Read More2025 Halloween Events Happening in Dallas-Fort Worth

Buying a home is more than bricks and interest rates. It’s about becoming a part of a community. It’s about local schools, events, neighbors, the “feel” of a neighborhood. As we head into one of the most fun seasons of the year, I wanted highlight some great Halloween events around the Dallas-Fort Worth area. My hope:…

Read MoreThe Federal Government Shutdown: What Does This Mean for Your Mortgage?

With the federal government currently shutdown, many homebuyers may start to wonder: Will this affect my ability to get a mortgage? The good news is that as of right now, the current federal government shutdown here in October 2025 has had little to no impact on the mortgage process. Lenders are still open, rates are…

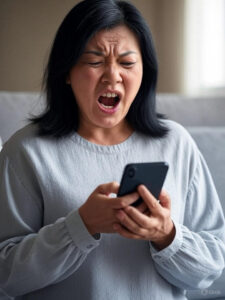

Read MoreAre you tired of getting your phone blown up with calls from hundreds of other lenders after you apply somewhere for a Mortgage?

Relief is on the way! What the Homebuyers Privacy Protection Act Means for You: Protecting Your Personal Info During the Mortgage Process In the digital age, privacy is more important than ever, especially when you’re sharing sensitive financial and personal information to buy a home. That’s where the Homebuyers Privacy Protection Act (HPPA) comes in.…

Read More