Posts Tagged ‘credit score’

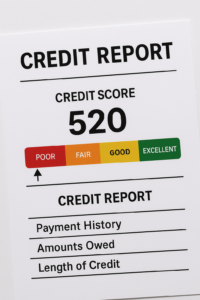

Steps to Credit Score Improvement: A Practical Guide for Future Homebuyers

Your credit score is one of the biggest factors in your ability to buy a home and in determining what your interest rate is. A higher credit score can mean better mortgage options, lower interest rates, and thousands of dollars saved over the life of a loan. If you’re struggling with less-than-perfect credit, there’s always…

Read MoreWhat Credit Score Do You Need to Buy a Home?

One of the most common questions I hear from homebuyers is: “What credit score do I need to buy a house?” The short answer is – it depends. There’s no single magic number, there are many different mortgage products with different qualifying credit scores, and you may be closer to homeownership than you think. Let’s…

Read MoreHow to Improve Your Credit Score for a Better Mortgage Interest Rate

When it comes to buying a home, your credit score isn’t just a number, it’s one of the most influential factors shaping the interest rate you’re offered. A higher credit score can save you hundreds of dollars a month and tens of thousands of dollars over the life of your loan, while a lower score…

Read MoreHow to Refinance with a Low Credit Score

Refinancing your mortgage can be a powerful financial move: lowering your monthly payment, shortening your loan term, or tapping into your home’s equity. But what if your credit isn’t perfect? Many homeowners assume they’re “stuck” with their current mortgage if their credit score isn’t ideal. The truth is, refinancing with lower credit is possible, and…

Read MoreMortgage Pre-Approval: What is it, and what will it require?

The Pre-Approval Checklist: What You Need Before You Apply House hunting without a mortgage pre-approval is like shopping without your wallet – you might find “the one” but can’t make it yours. Getting Pre-Approved for a Mortgage not only gives you a clear picture of your budget, but it also shows sellers you’re a serious…

Read MoreTop Mistakes to Avoid During the Mortgage Process

(and How Homebuyers Can Keep Things Smooth) Buying a home is exciting, but the mortgage process can sometimes feel overwhelming. Whether you’re a first-time homebuyer in Dallas-Ft Worth or anywhere, a few common mistakes can slow you down, or even cost you your dream home. As a Mortgage Loan Officer who is licensed to do…

Read MoreStep-by-Step Guide to Buying Your First Home: A First-Time Buyer’s Roadmap

Buying your first home is exciting, but it can also feel overwhelming if you don’t know where to start. As a mortgage loan officer, I work with first-time buyers every day, and I know that having a step-by-step plan can make all the difference. Here’s a simple guide to help you feel confident every step…

Read MoreGet Mortgage-Ready: 5 Things to Do Before You House Hunt

Buying a home is an exciting milestone in anyone’s life but jumping into house hunting before you’re prepared can make the process unnecessarily stressful and can lead to missed opportunities or disappointment. As a mortgage loan officer, I’ve seen firsthand how preparation can make the homebuying process so much easier. Here are 5 smart steps…

Read More