Uncategorized

“Whom do I ask for what?!?!” Clarification of the different Roles of Your Mortgage Officer and your Realtor when Buying a Home

Buying a home is an exciting, and sometimes overwhelming, financial and personal milestone. For seasoning homebuyers as well as first-time homebuyers, there are always questions that come up along the way. In those situations, quite often I see buyers not understanding whom to ask what questions. For example, some buyers will talk to their Realtor…

Read More5 Ways to Save for a Down Payment Faster

One of the biggest hurdles for homebuyers is saving for the down payment. While it can feel like a daunting task, with the right plan in place, you can build your savings faster than you think. Whether you’re a first-time buyer or looking to move from your current home, here are five smart ways to…

Read MoreWhat the Fed’s Rate Cut Really Means for Mortgage Rates

This past Wednesday, the Federal Reserve announced a much-anticipated rate cut, and as expected, it has sparked a lot of confusion among homebuyers and homeowners alike. Many people assume that when the Fed cuts rates, mortgage rates automatically fall. But that’s not actually how it works. Let’s clear up the difference between the Fed’s rates…

Read MoreFive Top Cities in Denton and Collin County for First-Time Homebuyers

You know the age-old saying that what matters in real estate is the 3 L’s: Location, Location, Location! Buying your first home is an exciting step, and if you’re buying your first home in the Collin or Denton county areas, you may be wondering where’s the best Location for you. These areas provide a balance…

Read MoreWhy is housing so expensive right now, and what will it take to fix it?

Being in the real estate and mortgage industry, I study this stuff every day and sometimes I catch myself having to slow down and mentally put the pieces together again, so I can’t imagine what it’s like for folks who are not in the industry. A lot of people want to buy a home right…

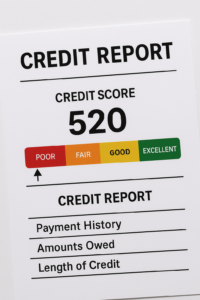

Read MoreHow to Refinance with a Low Credit Score

Refinancing your mortgage can be a powerful financial move: lowering your monthly payment, shortening your loan term, or tapping into your home’s equity. But what if your credit isn’t perfect? Many homeowners assume they’re “stuck” with their current mortgage if their credit score isn’t ideal. The truth is, refinancing with lower credit is possible, and…

Read MoreThe Honor of Being Named One of D Magazine’s Best Mortgage Professionals

Being named one of D Magazine’s Best Mortgage Professionals is a true honor, and this year, Rob Kuehne has proudly earned that recognition. This award carries special significance, as it not only highlights excellence within the mortgage industry but also reflects the trust and confidence placed in Rob and his team by both clients and…

Read MoreHow Friday’s Speech by the Fed Chairman Could Affect Your Mortgage Rate

If you’ve been keeping an eye on mortgage rates, you’ll know they’ve been a bit of a roller coaster lately – with ups and downs and ending up pretty much at the same place we started. However, last Friday, Federal Reserve Chairman Jerome Powell gave a pivotal speech at the Jackson Hole symposium that could…

Read MoreWhy Knowing Your Home’s Worth and your Equity Is So Important to Growing Your Personal Wealth

Real Estate remains one of the very top ways folks can build wealth in America. Your home isn’t just where you live, but when utilized correctly, it’s your biggest financial asset. But here’s the thing: many people don’t actually know what their home is worth today, how much equity they’ve built over the years, and…

Read MoreSo, When Does It Make Sense to Refinance Your Mortgage?

With so many opinions floating around within our coworkers, friends, and families, knowing when to Refinance can easily feel confusing. And so many Mortgage Lenders (not my team or me) will always say “right now” is the best time to refinance, because they aren’t concerned about your best interests, they’re only concerned about getting another…

Read More